While the early crypto buzz has settled, the energy around DeFi app development is far from dissipating. What started as experimental finance is now a serious market with over $118 billion in total value locked across protocols, active users, and steady innovation. People are still into new ways to tokenize, trade, lend, borrow, and monetize just nearly everything.

No wonder entrepreneurs would love to build products people actually use, whether it's a trading platform, a lending protocol, or a fresh take on fundraising. Building a DeFi app means stepping into a space where ownership, transparency, and automation are the foundation for great business cases.

But how to build a DeFi app moving from a bold idea to a working DeFi product?

In this guide, we’ll break down how to create a DeFi app, from the business decisions you’ll need to make to the tech stack and compliance challenges you shouldn’t ignore. Whether you’re planning a lending protocol, a decentralized exchange, or something totally fresh, we’ll help you do it the right way.

Let’s start with the basics and then get into the real ‘how-to’ of launching your DeFi app.

What is DeFi?

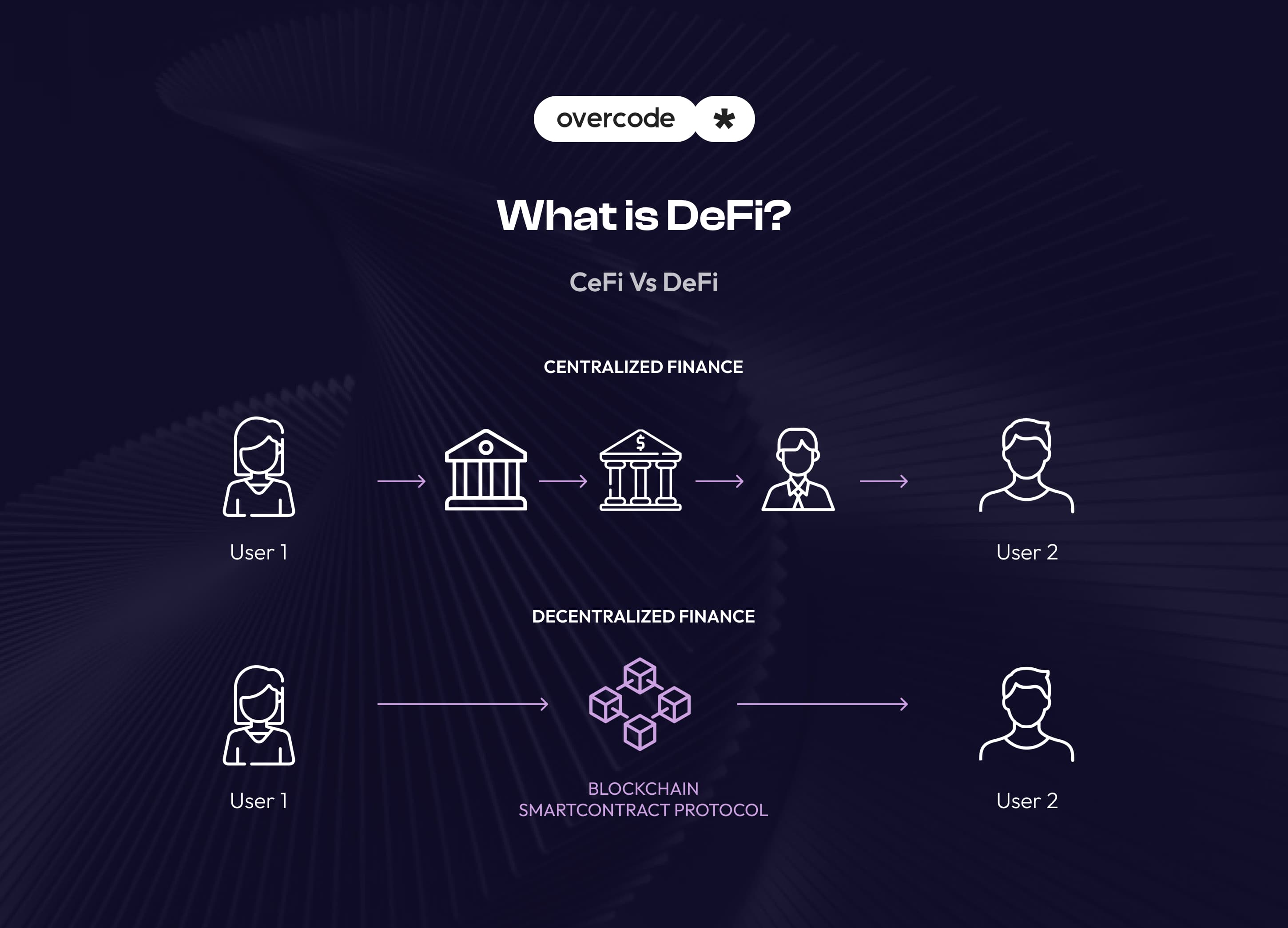

DeFi stands for decentralized finance and refers to blockchain-based software, services, and applications that handle financial operations. The core idea is to remove third parties – most often banks – from the financial system, reducing both costs and transaction times. Instead of relying on traditional institutions, decentralized finance solutions are built around smart contracts – self-executing code on a blockchain that runs transactions automatically, without intermediaries.

What is DeFi when put simply? Think of it like this: if you agree to rent out your digital asset for a fixed fee, the smart contract holds the asset and releases it to the renter only after payment is received. Once the rental period ends, it automatically returns the asset to you – no third party needed.

At the core of DeFi are secure, anonymous, and unchangeable transactions. Because these properties are built into blockchain technology, many blockchain apps are DeFi by default.

What is the purpose of DeFi applications running on blockchain technology?

The core idea of decentralized finance (DeFi) development is to give people complete control over their money without relying on banks or third-party services. DeFi apps use blockchain to replace centralized control with code, removing traditional gatekeepers like banks, credit institutions, brokerages, and payment processors. This makes financial services open, transparent, and accessible 24/7. Users can borrow, lend, save, trade, and earn interest without asking for permission. Every transaction is recorded on-chain, verifiable by anyone, and resistant to tampering.

Advantages of DeFi applications

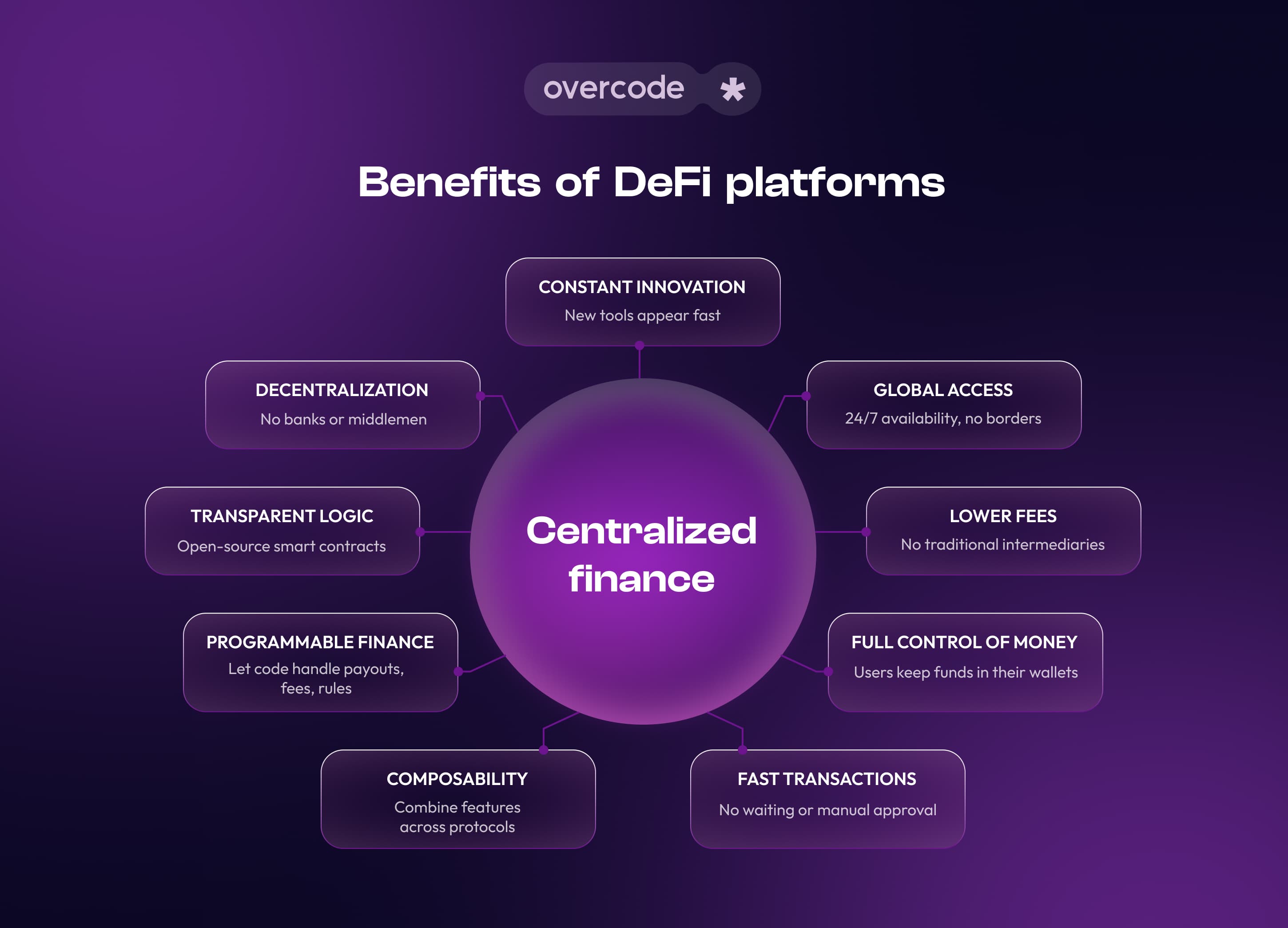

If you ask what one of the main advantages of DeFi applications is, the first and most accurate answer is the combination of security, speed, and user control – all baked into the tech. But decentralized finance solutions have plenty more to offer:

Decentralization. No banks, brokers, or payment systems involved – just users and code.

Transparent logic. Smart contracts are open-source, so users can see exactly how their money moves.

Programmable finance. Set payouts, interest, fee splits, and other rules once, and let the code handle the rest.

Composability. DeFi apps can interact with each other. One protocol can use features of another, making it easy to build complex tools from simple parts.

Fast transactions. No waiting for approvals or third-party processing, as actions are executed almost instantly.

Full control of money. Funds stay in a user’s wallet, meaning there will be no custodian, mediator, or other lock-ins.

Potentially lower fees. No banks or brokers taking a cut – just network and protocol fees, which vary by platform and traffic.

Global access and 24/7 availability. Anyone with a wallet and internet can use it. No borders, no paperwork. No closing hours either. Everything runs non-stop, all year round.

Constant innovation. New protocols and tools pop up fast. It’s a growing market with a rapid pace of change.

These opportunities become real only when the right architecture is in place.

Decentralized finance (DeFi) development: Step by step

This part is meant to show you how to build a DeFi app in five steps – all clearly defined and explained.

Step 1 – Discovery & Scoping

Let us help you pinpoint what type of DeFi product fits your business goals, who your target users are, and why it matters. That means mapping out the functionality, risks, and core mechanics before actual coding begins.

What types of digital tools and products can be created using DeFi applications?

In DeFi, it’s normal for a single product to combine multiple features. A wallet, for example, might also offer built-in swaps, staking, or lending. This flexibility comes from composability – one of DeFi’s biggest strengths.

So, while we list different types of DeFi apps below, keep in mind that many real-world products blend several of these functions into one.

The common types of DeFi-based products:

| Type | What it does | Popular examples |

|---|---|---|

| Decentralized Exchanges (DEX) | Let users trade tokens directly, peer-to-peer (P2P), without intermediaries. The user can also get data on spot prices, markets, the growth or decline of crypto, and the liquidity of credit transactions. | Uniswap. Ethereum & Layer 2s PancakeSwap. Binance Smart Chain Curve Finance. Ethereum & EVM Chains 1inch. DEX Aggregator) SushiSwap. Multi-chain) |

| NFT apps | Let users mint, trade, and manage non-fungible tokens – unique digital assets that can represent art, music, collectibles, or any other item with individual value. Unlike cryptocurrencies, NFTs aren’t interchangeable, which makes them ideal for proving ownership of one-of-a-kind or limited-edition content. | OpenSea. Multi-chain marketplace for all types of NFTs. Blur. NFT trading platform focused on pro traders. Zora. Minting platform and protocol for media NFTs. Magic Eden. Leading Solana-based NFT marketplace. Foundation. Creator-focused marketplace for digital art. |

| Crypto wallets | Being an identity and access point on the blockchain, they don’t store your funds directly but hold the private keys that prove ownership of the assets. You can think of it as a banking app but without the bank. Thanks to decentralized finance wallet development, one can view balances, send or receive tokens, and interact with DeFi platforms like Ethereum, Solana, etc. | Coinbase Wallet. A non-custodial wallet that supports DeFi and NFTs, separate from the Coinbase exchange. MetaMask. Browser and mobile wallet for Ethereum and EVM-compatible chains. Trust Wallet. Mobile wallet with support for multiple blockchains and DeFi dApps. Rabbi. Lightweight wallet designed for Ethereum and L2s. Frame. Desktop and browser wallet focused on security and developer integrations. |

| DeFi banking | Offers familiar services (savings, transfers, payments, etc.) but runs on smart contracts – minus the constraints of conventional banking systems. | Compound. A popular platform that lets users earn interest or borrow assets using smart contracts. MakerDAO. Allows users to generate the DAI stablecoin by locking collateral and enabling decentralized loans. Vast Crypto Banking. Provides crypto savings, interest accounts, and smooth fiat-to-crypto services. |

| Lending & borrowing | Let users lend or borrow assets instantly with algorithm-driven interest rates. Smart contracts automatically set terms like amount, duration, and rates, making loans faster, cheaper, and more accessible than traditional credit. | Aave. Leading protocol for lending and borrowing crypto with variable and stable interest rates. Compound. A popular platform that lets users earn interest or borrow assets using smart contracts. MakerDAO. Allows users to generate the DAI stablecoin by locking collateral and enabling decentralized loans. Euler. Supports overcollateralized loans with a soft liquidation mechanism, allowing higher Loan-To-Value ratios. Maple Finance. Enables undercollateralized loans through trusted pool delegates, offering fixed-term, fixed-rate loans. |

| Yield aggregators | Pull together different DeFi protocols to find the best returns on crypto. They automatically move funds between platforms to boost passive income without having to manage each one manually. | Yearn.finance. Automates yield strategies across multiple protocols to maximize returns. Beefy Finance. Focuses on optimizing yields through automated compounding on Binance Smart Chain and other chains. Autofarm. Offers cross-chain yield aggregation with low fees and flexible strategies. Harvest Finance. Helps users earn by pooling assets and optimizing farm rewards automatically. |

| Crowdfunding platforms | Enable decentralized fundraising using tokens or smart contracts | Gitcoin. Known for supporting open-source projects with a strong, active community and regular grant rounds. Seedify. Popular as a launchpad and incubator. Mirror. Valued in the creative and media sectors. KickPad. Well-known for its user-friendly token sale and fundraising services. |

| DAOs | Decentralized Autonomous Organizations (DAOs) let members collectively decide on rules, budgets, and project directions by voting with tokens they hold. | Aragon. Lets communities set up and manage their own governance structures easily. MolochDAO. Pools funds and votes on grants for Ethereum development. Curve DAO. Enables users to vote on protocol updates and fund improvements. |

Step 2 – Create a design

Decentralized finance development includes both backend logic and the way users interact with smart contracts. Designing a DeFi app means carefully considering how users interact with smart contracts while keeping risks low and information clear. From our experience, creating great DeFi products, especially for beginners, rests on three key principles:

Simplicity

Transparency

Literacy (helping users understand without constant hand-holding)

Good DeFi UI/UX should:

Clearly show what users are agreeing to – including interest rates, fees, terms, and conditions.

Reduce mistakes, like sending tokens to the wrong address.

Simplify complex tasks like staking, borrowing, or swapping.

Work smoothly across all devices, especially mobile, since many users manage funds on their phones.

This phase also includes mapping user flows for wallets, error messages, loading times (while waiting for blockchain confirmations), and backup plans when things don’t go as expected. It’s also the stage where you plan every screen, user action, and app state before handing it off to developers.

Step 3 - Tech stack for DeFi app development

Let’s focus on tools and technologies widely used in the decentralized finance development process to ensure security, performance, and smooth user experiences. But first, let’s choose the right blockchain platform. Your choice will depend on the platform’s ability to balance security, cost, speed, and developer resources to match your DeFi product’s goals.

Blockchain platforms for DeFi solutions development

Have a look at our table to compare how these platforms fit decentralized finance development:

| Platform | Transaction Speed | Gas Fees | Security | Developer Tools | DeFi Strengths |

|---|---|---|---|---|---|

| Ethereum | Moderate | High | Very strong, battle-tested | Mature, extensive | Largest ecosystem and dev community |

| Solana | Very fast | Very low | Growing, efficient | Focused on scalability | High throughput, ideal for real-time trading and apps requiring speed |

| Binance Smart Chain | Chain | Low | EVM-compatible, solid | Easy for Ethereum devs | Low cost, widely adopted for DeFi forks and new protocols |

| Polygon | Fast | Very low | EVM-compatible | Strong Ethereum compatibility | Layer 2 scaling for Ethereum, low fees, growing DeFi projects |

| Avalanche | Fast | Low | Secure, rapidly growing | Good support for DeFi | High throughput, supports custom DeFi chains and subnets |

| Arbitrum | Fast | Low | Ethereum-grade, scalable | EVM-support, strong toolset | Popular L2 with growing liquidity and app adoption |

| Optimism | Fast | Low | Inherits Ethereum security | EVM-compatible | Supports modular rollups, active DeFi community |

| Base | Fast | Low | Built on Optimism stack | Coinbase-backed, EVM-based | Fast adoption via Coinbase ecosystem, growing DeFi use |

| Ton | Very fast | Low | Telegram-integrated, evolving | SDKs for bots and dApps | Growing user base via Telegram, light wallets, and payments |

| Polkadot | Moderate | Low | Shared security via relay chain | Substrate framework | Cross-chain DeFi possible via parachains and bridges |

Smart contract architecture

Smart contracts run the core logic of DeFi apps. For Ethereum, Binance Smart Chain, Polygon, and all EVM-compatible in general, we mainly use Solidity or Vyper. These let us build everything from payments to governance rules. For Solana and Avalanche, Rust and Go are common choices because they offer faster processing and better multitasking.

Frontend / Web3 integration

To craft the user’s gateway, we rely on React paired with Web3.js or Ethers.js. They are the go-to choice for building reliable, real-time interfaces that let users track balances, send transactions, and interact with contracts.

For decentralized finance wallet development, the good choices will be MetaMask, WalletConnect, Ledger, Trezor, and others to ensure secure key management and easy signing.

Backend & Infrastructure

Choose Node.js to develop backends that interact with blockchains like Ethereum, BNB Chain, Polygon, and Avalanche. It’s lightweight and combines well with libraries like Web3.js and Ethers.js, which are necessary for working with smart contracts and blockchain nodes.

For Solana, you can use Rust, the native language for its smart contracts, or Go for off-chain backend tasks. Both are capable of parallel processing and performance-intensive workloads.

You can use third-party services such as Infura, Alchemy, or QuickNode to avoid having to manage the infrastructure yourself. That said, it may be better to host your own node if you need complete control and consistent access to blockchain data or want to bypass API rate limitations.

Providing security

Security can’t be an afterthought in decentralized finance DeFi development since DeFi apps handle real funds, and even a small bug can cause serious losses. We design smart contracts with security-first logic, audit them with tools like MythX and Slither, and run automated tests to catch issues early.

We also review every interaction between the frontend and the blockchain: validating inputs, minimizing exposed functions, and using read-only calls where possible. This keeps user actions predictable and the attack surface small.

Step 4 – Testing and audit

At Overcode, we write unit tests to validate every contract function and edge case using tools like Hardhat or Foundry. Then, we test the whole app flow: wallet connections, transactions, and UI feedback to catch integration issues before users do.

Before launch, we run static analysis with Slither or MythX and follow up with manual audits. These help us catch logic errors, security risks, and anything automated tools miss.

Step 5 – Deployment & post-launch monitoring

We only push contracts to the mainnet after passing audits and use verified deploy scripts to keep builds consistent and reproducible. Deployments are handled via scripts using frameworks like Hardhat or Foundry to ensure reproducibility, avoid manual errors, and tag contract versions for traceability.

Post-launch, you should track on-chain metrics, gas usage, and contract interactions. Frontend errors, failed transactions, and unusual behavior are logged and reviewed in real time.

You should also gather user feedback early on, paying particular attention to usability. This helps prioritize bug fixes and UX tweaks without taking risks.

In DeFi, user trust depends on stability and responsiveness. Therefore, you should consider monitoring as an ongoing task and not a checkbox.

Ready to map out your DeFi product idea?

We’ll help you plan and take the right steps from day one.

Challenges in building a DeFi app

Before you put time and money into decentralized finance DeFi app development, it’s good to know what kinds of problems might pop up. We’ve gone through the common issues and found some solutions, so you don’t have to risk making the same mistakes others have already faced.

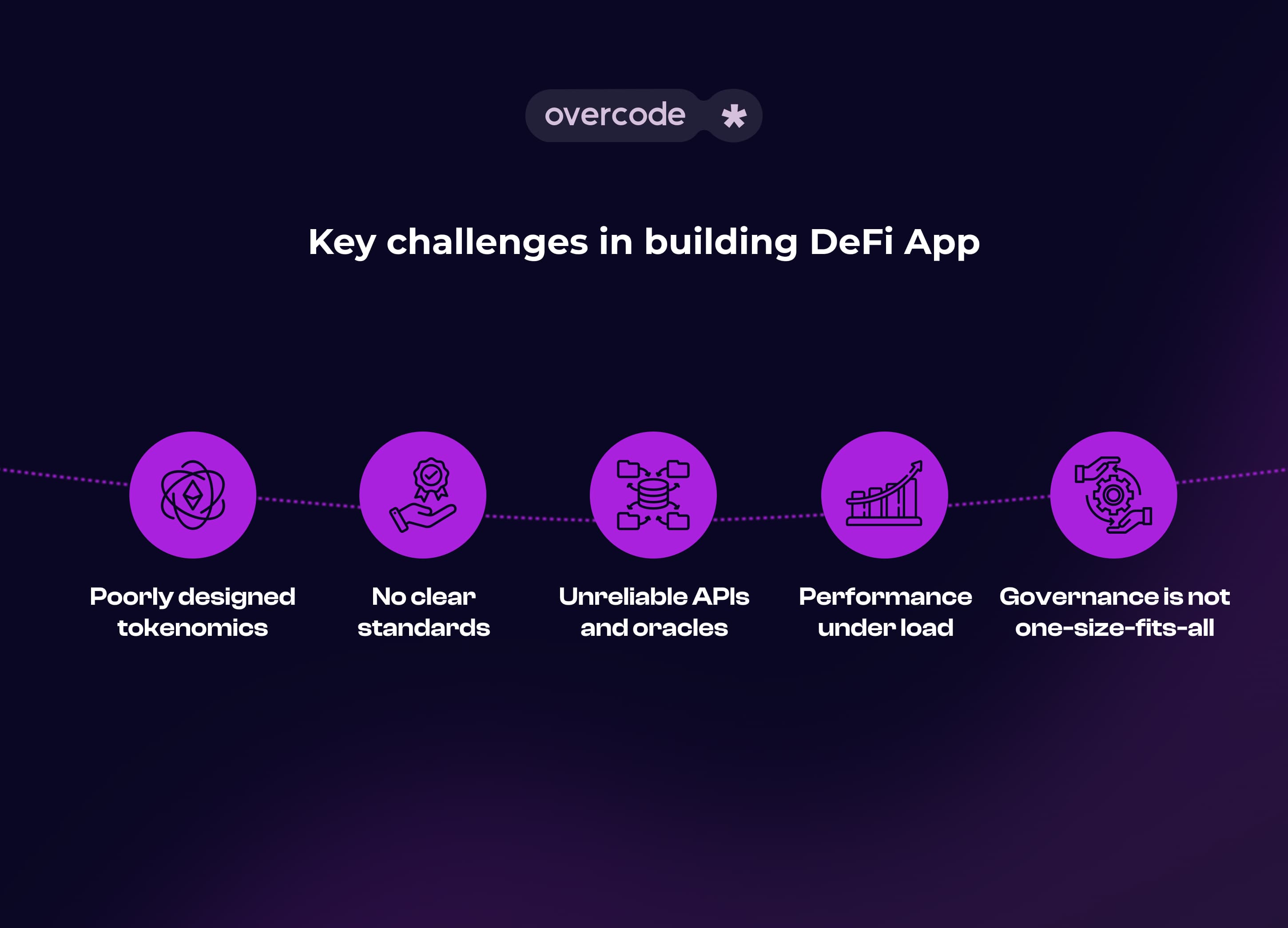

Poorly designed tokenomics

Tokenomics refers to the design of your token’s supply, distribution, and utility. As long as tokenomics is considered the economic engine behind your DeFi product, poorly designed models can sink the project before launch. You need a structure that balances utility, incentives, and long-term sustainability. It should also include realistic emission schedules, clear token use cases, and safeguards against inflation or price manipulation.

No clear standards

Unlike traditional fintech, DeFi lacks standard protocols across chains. Every integration requires custom work, from wallets to cross-chain bridges that move assets between blockchains. What works on Ethereum may need rewriting for Solana or Avalanche. Your users may expect multi-chain support, but without shared standards, delivering it depends heavily on your team’s expertise and adaptability.

Unreliable APIs and oracles

You may lack on-chain data for features like price feeds, cross-chain visibility, or real-world inputs. For that, DeFi apps depend on oracles and third-party APIs. Users may see incorrect balances, bad swap rates, or even lose funds if they fail or lag.

To avoid this, build fallback logic, cross-check data from multiple sources, and choose providers with a solid record of uptime and transparency. You'll have to mind, though, that these protections add cost and complexity, so your team must know how to balance resilience with performance.

Performance under load

In DeFi app development, performance is a sensitive matter that can be impacted by high gas fees, slow transaction times, and network congestion. You should optimize your apps for speed and cost to achieve stable, positive performance during peak times. This isn’t always a simple task, though, as overcoming these issues demands solid blockchain expertise and well-thought-out design.

Governance is not one-size-fits-all

DAO frameworks are still evolving. Some projects go fully on-chain, while others keep decision-making more centralized early on. You’ll need to pick a model that fits your stage and community maturity and be ready to evolve it over time.

DeFi app ideas: Real-world use cases

DeFi is moving beyond experimental protocols and has already powered real business models. If you're still exploring what types of digital tools and products can be created using DeFi applications but want a sharper look at where innovation meets practical value, here are some inspirational real-world use cases.

NFT-backed lending: Volt by Overcode

One example of a real-world DeFi application is Volt, a peer-to-peer lending protocol Overcode built on the Base blockchain. It lets users borrow crypto by using NFTs as collateral, so there is no need to sell assets just to access liquidity.

Volt focuses on fast transactions, clear loan tracking, and a user-friendly experience. Borrowers and lenders interact directly and use flexible loan terms and transparent data on platform activity. There’s also a paid tier with extra tools.

While Volt is live, Overcode also has the technical and product expertise to deliver other in-demand DeFi applications. Here are several more business-ready DeFi app ideas in line with today’s market trends:

Synthetic assets for investment platforms

Let users invest in tokenized representations of stocks, commodities, or fiat without leaving the blockchain.

Great for fintechs or investment DAOs looking to expand access to traditional markets. These platforms are gaining traction as a bridge between DeFi and TradFi.

GameFi vaults & asset markets

Let players stake in-game NFTs or tokens, lend rare assets, or participate in tokenized game economies.

As the wave of Web3 games matures, developers need DeFi infrastructure and specific services, such as decentralized finance wallet development services, for instance, to support asset ownership, liquidity, and monetization. For this reason, GameFi is said to grow at a 17.3% CAGR from 2025 to 2033, reaching around $120.3 billion by 2033.

Cross-border payments & remittances

Build stablecoin-powered payment rails with smart contract settlement, skipping traditional intermediaries.

Businesses operating in high-fee corridors like Latin America or Africa are looking for ways to reduce transaction costs. Considering that remittance fees average 6.4% globally, with higher costs in sub-Saharan Africa, for example, blockchain-based payments, especially stablecoins, could be a reasonable and cost-effective alternative.

Stablecoin yield tools for DAOs and SMBs

Build decentralized finance solutions that would help DAOs and small crypto-native businesses earn interest on idle USDC or DAI reserves. These treasury tools would let them put stablecoins to work with minimal risk and no intermediaries.

In 2024, crypto startup funding fell nearly 46% from Q1 to Q4. Q1 2025 saw a modest rebound, yet most of it came from one giant $2 billion Binance deal. So yes, the investors are still very selective.

Stablecoins like USDC and DAI are attractive here because they’re liquid, stable, and widely accepted in DeFi protocols. Platforms like Yearn, Llama, and Idle ease passive yield earning, even for users without heavy DeFi experience.

Unlike traditional bank deposits, these tools offer on-chain access, transparent returns, and permissionless entry. All these features are aligned with how DAOs and globally distributed teams operate.

Decentralized finance security solutions

Build on-chain tools that monitor smart contracts, flag suspicious activity, or automate emergency responses like pausing transactions.

Hacks and exploits are grand: according to Crypto Crime Report 2025, in 2024, hackers stole around $2.2 billion from crypto platforms, up 17% from the $1.8 billion lost in 2023. More than serious reasons to make security a core feature. So, you can work on projects building decentralized finance security solutions that offer real-time threat detection and automated response tools.

How much does it cost to develop a DeFi app?

The cost of developing a DeFi app can range anywhere from $45,000 to over $300,000, depending on the app’s complexity, features, blockchain platform, and the expertise of the DeFi app development team.

At Overcode, we’ve analyzed typical pricing structures and team compositions used in the market. Here's a breakdown based on current industry benchmarks and mapped on our team's experience in building blockchain-based solutions.

| Component | Estimated Cost Range (USD) |

|---|---|

| Discovery & planning | $5,000 – $15,000 |

| UI/UX design | $8,000 – $20,000 |

| Smart contract development | $15,000 – $60,000 |

| Backend & API integration | $12,000 – $40,000 |

| Frontend development | $10,000 – $30,000 |

| Blockchain integration | $8,000 – $25,000 |

| QA & security audits | $10,000 – $50,000 |

| Post-launch support & updates | $5,000 – $20,000+ |

Note: The provided figures are based on Overcode’s internal data and market analysis. The final DeFi app development cost will always depend on the scope of your solution, whether you're building from scratch or improving an existing application. Either way, we’ll help you choose the right tech stack, factor in regulatory requirements, and work toward the balance of quality, cost, and time to market.

Already have a DeFi app idea in mind? Let’s estimate the cost based on its scope, features, and target blockchain. Request a quote

What should you expect from an outsourcing partner?

So, what if you’ve got the product vision, maybe even some tech know-how, but you’re short on people, time, or deep blockchain expertise? That’s where you can start considering outsourcing as one of the smartest moves for DeFi startups that need to roll fast, test ideas, and stay lean.

Not all outsourcing partners are created equal.

Here’s what a solid technology partner looks like, especially when you’re planning how to create a DeFi app:

Offers real cost advantages. You can expect experienced teams with mature processes that save you time, avoid rework, and deliver at 60% to 78% fewer labor costs (more figures with reasoning in our outsourcing vs in-house development article).

Grants fast onboarding. They don’t waste time “getting up to speed.” The right vendor should drop in ready-to-code talent with blockchain experience already in their pocket.

Has a focused tech stack. No one is great at everything. Look for a partner with actual experience in your chosen tools, whether Solidity, Substrate, or ZK tech, or in specific areas like decentralized finance wallet development services instead of a one-size-fits-all offer.

Builds trust. Talk to their team, talk to their management. Would you want to build with them again after this MVP? At Overcode, we don’t rank projects by size, whether it’s an MVP or full-scale DeFi build; we treat every client as a long-term partner, not a one-off assignment.

Has a proven track record. Look for public client feedback, like that on Clutch, real-world DeFi cases, and community engagement.

Offers scalability on demand. DeFi markets move fast. Your team should, too. A good partner helps you scale up or down as needed without long-term overhead.

Has a product-focused mindset. You need a partner who understands startup product development and cares about shipping something that works, gets users, and passes audits, not just writing code.

Gives you breathing room. While they handle development, you focus on talking to users, iterating on the business, or preparing for that investor demo next Friday.

That wraps up our guide on how to build a DeFi app, so we hope it made things clearer.

We walked you through the major advantages of DeFi, outlined the core product types, and broke down each step of the development process. Throughout the stages from discovery and design to testing, deployment, and ongoing monitoring, we also highlighted the challenges you should plan for.

We’ve also explicitly answered the question, “What is the purpose of DeFi applications running on blockchain technology?” – showing how they give people financial power without banks, using code that can’t be tampered with.

If you're still unsure where to start or want a second opinion on your idea, our team at Overcode is just a message away. Scroll through our cases, drop us a line, and let’s build something worth launching.

Not sure if your DeFi idea is realistic?

We'll help you validate it before you invest a cent.